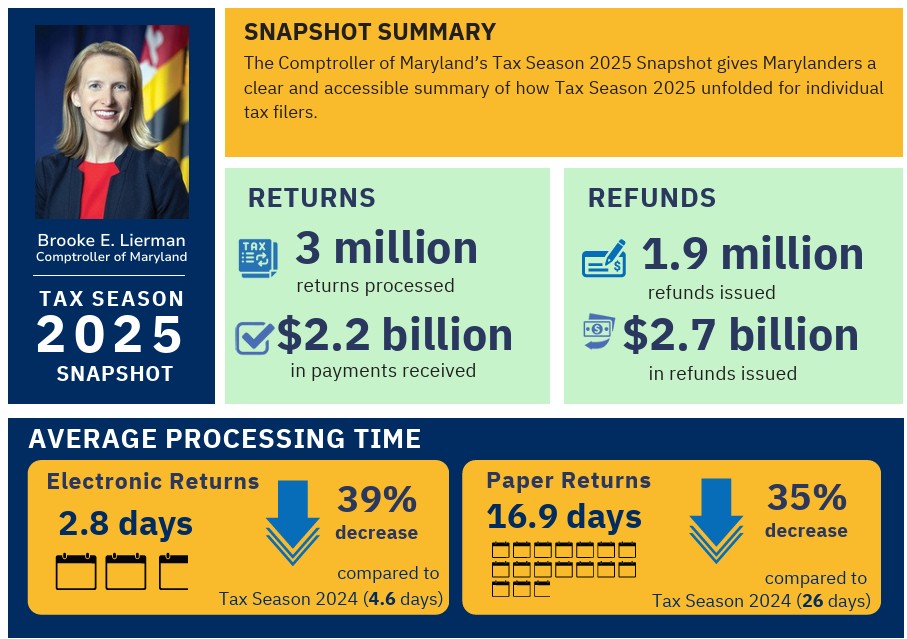

Comptroller Brooke Lierman announced that Maryland processed over 3 million tax returns and issued $2.7 billion in refunds during the 2025 tax season, significantly reducing processing times and increasing claims for the Earned Income and Child Tax Credits.

Per the news release: “Comptroller Brooke E. Lierman today released a

“snapshot” report

, highlighting the agency’s progress in processing personal income taxes during the 2025 tax filing season.

Between January 20 and May 30, 2025, the Office of the Comptroller processed more than 3 million personal income tax returns and issued $2.7 billion in refunds to 1.9 million taxpayers. During that same period, the agency took less than 3 days on average to process returns filed electronically, compared to nearly 5 days for the same period last year (a 39% decrease). The average processing time for paper returns also fell to 16.9 days, compared to 26 days during the previous year (a 35% decrease).

In addition to a decline in the wait times for return and refund processing, the agency saw an increase in the number of taxpayers filing for the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC). Agency data shows more than 444,000 claims for the EITC for tax year 2024, with a value of $519 million (7.8% growth). Meanwhile, more than 54,000 people claimed the Child Tax Credit, totaling $9 million (5% growth). In January, the Office of the Comptroller launched the

Earned It campaign

, in partnership with the Governor’s Office of Children and a number of state agencies, encouraging eligible Marylanders to claim the EITC and CTC. The agency plans to expand the campaign utilizing funding from the Maryland General Assembly later this year.

“While there is still work ahead in making tax processing faster and more efficient, I am encouraged by the significant progress we have made in the last year to cut tax processing times and increase the number of Marylanders claiming the tax credits that belong to them,” Comptroller Lierman said. “This is a direct result of our continued agency modernization efforts and the hard work and commitment of our team. We will continue to build on these improvements and find new ways to enhance the taxpayer experience.”

Marylanders with questions about their tax filing or refund status can now access that information using the agency’s new

MyCOMConnect customer service portal

, available on the Maryland Comptroller’s Website by clicking “Get Help.” MyCOMConnect also allows taxpayers to schedule appointments with the Taxpayer Services Division and access other key resources