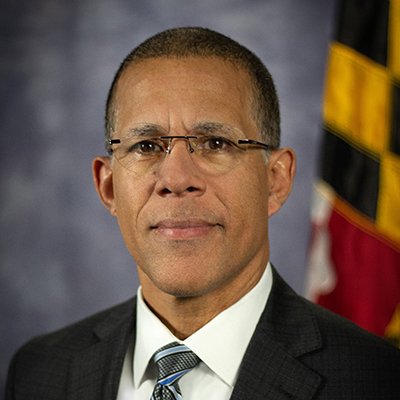

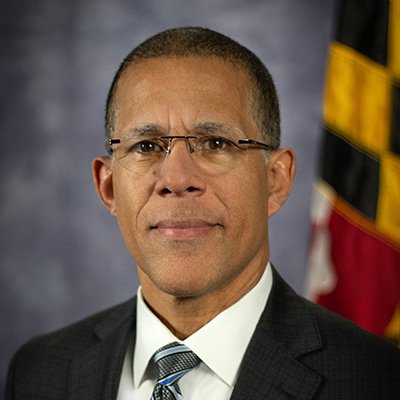

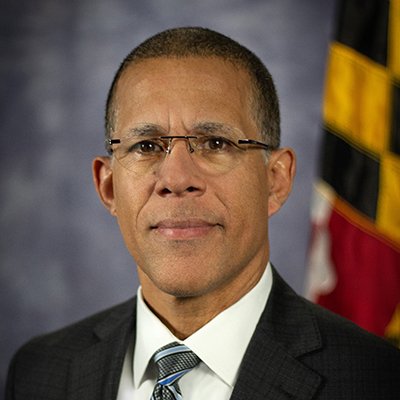

Citing public safety, regulatory supervision, and economic benefits, Attorney General Anthony G. Brown and a bipartisan coalition of attorneys general are encouraging Congress to enact the SAFER Banking Act of 2025, which would permit financial institutions to serve state-regulated cannabis businesses.

Attorney General Anthony G. Brown today co-led a bipartisan coalition of attorneys general in urging Congress to enact the SAFER Banking Act of 2025, according to the news release issued on Thursday, July 24. In order to address serious public safety concerns and enhance states’ capacity to collect taxes and carry out regulatory oversight, the coalition wrote to congressional leaders urging the passage of legislation that would give banks and financial institutions the legal clarity they need to serve state-regulated cannabis businesses.

The letter highlights how present federal banking limitations force legal cannabis firms to rely mostly on cash, posing needless hazards to public safety. This cash-intensive atmosphere undermines states’ ability to properly regulate and tax these companies while making workers and customers targets for violent crime.

The group draws attention to the substantial economic impact of cannabis sectors that are subject to governmental regulation. The letter claims that legal cannabis retail sales in the United States reached $30.1 billion in 2024, a 4.5% year-over-year rise, and supported almost 425,000 employment across the country. By the end of 2025, industry analysts predict that the total yearly sales of licensed cannabis in the United States might amount to $34 billion.

While 24 states, two territories, and the District of Columbia have legalized cannabis for adult use, 39 states, three territories, and the District of Columbia currently allow the use of cannabis for medical purposes. Currently, around 75% of Americans reside in states where cannabis has some kind of legalization.

The attorneys general point out that although 21 states presently collect cannabis tax revenues, banking institutions have refused to deposit cannabis-related payments to numerous state agencies.

The organization stresses that the SAFER Banking Act would not alter cannabis’ federal legal status or promote its legalization in states that have decided not to allow it. In jurisdictions where laws and regulations guaranteeing responsibility in the cannabis industry have been put in place, the legislation instead establishes a focused safe harbor that permits depository institutions to offer financial services to covered enterprises.

The letter makes the case that law enforcement, local, state, and federal tax authorities, and cannabis regulators would be better equipped to keep an eye on cannabis firms and their transactions if cannabis commerce were integrated into the regulated banking system. With controlled tracking of monies in the banking system, tax regulations would be easier to follow and enforce, which would increase tax revenues.

The organization emphasizes that the bill respects state sovereignty and cannabis’s present federal status while still being bipartisan and commonsense. In order to move money from legal cannabis businesses into the highly regulated banking system, where it will be more transparent to state regulators and law enforcement, the SAFER Banking Act addresses specific public policy challenges that states face as a result of the federal prohibition on banking cannabis-related funds.

The attorneys general come to the conclusion that the legislation will allow for stability and economic growth in their respective states while also having a positive effect on the safety of Americans who reside in areas where cannabis has been legalized.

Ohio, Georgia, the District of Columbia, Alaska, American Samoa, Arizona, California, Colorado, Connecticut, Delaware, Hawai’i, Illinois, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, Northern Mariana Islands, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Dakota, U.S. Virgin Islands, Utah, Vermont, Washington, and West Virginia are among the attorneys general who joined Attorney General Brown in filing the letter.